|

|

| 1. Introduction |

Status

| MESSAGE TYPE | : DIRDEB |

| REFERENCE DIRECTORY | : D.01B |

| EANCOM® SUBSET VERSION | : 003 |

Definition

A Direct Debit is sent by the Creditor to the

Creditor's Bank instructing it to claim specified amount(s) from the Debtor(s) and to

credit the amount(s) to an account specified in the message, which the Creditor's Bank

services for the Creditor in settlement of the referenced transaction(s).

Note:

Throughout this document the term 'Creditor' refers to either a Beneficiary, Payee or

Supplier, likewise the term 'Debtor' refers to either an Ordering Customer, Payor, or

Buyer.

Prior to the Direct Debit procedure, some agreement(s) would usually have been concluded :

- agreement between the Creditor and his Bank (mainly to specify the conditions of credit and the kind of direct debit).

- agreement between the Debtor and the Debtor's Bank (i.e. pre-authorisation and condition of debit), or between the Creditor and the Debtor.

The term 'pre-authorisation' refers to an agreement between a Creditor and a Debtor for:

- either automatic debiting, as required,

- or for debiting unless rejected by the debtor in a period of time.

The agreement can also be made between the debtor and his bank, independently of the amount of the DIRDEB.

Principles

- A Direct Debit may cover the financial settlement(s) of one or more commercial trade transactions, such as invoices, credit notes, debit notes, etc.

- Several credit accounts, execution dates and currencies may be specified.

- Charges may be borne on account(s) different of the account(s) held by the Creditor.

- The Creditor's Bank may need a confirmation/authorisation from the creditor to be able to process the Direct Debit Message.

- Pre-authorised and non pre-authorised direct debits shall not be mixed within the same message.

- The only way to modify a Direct Debit message is to cancel the whole message or a transaction thereof (e.g. by the use of the FINCAN message). In that respect, one to many order(s) could be cancelled within the message, avoiding to be obliged to cancel the whole message.

- The originator of the message can only effect the cancellation of a Direct Debit message. The kind of cancellation is dependent upon the process of the message or a transaction of it.

* Notes.

The Multiple Direct Debit message is structured in three levels: A, B, and C.

Level A

Header Section - This section, A, contains general data related to the whole message and is contained in Segment Groups 1, 2, 3 and 24.

Level B

Credit Side Detail - This section, B, contains batches of data. Each batch is organised from the credit side’s perspective, i.e. one credit account, one currency, one execution day and one credit batch total amount. Each batch then contains detailed data which applies to all the dependent C levels, i.e. the individual direct debit transactions, and is contained in Segment Group 4 through Segment Group 10.

Level C

Direct Debit Detail - This section, C, contains data related to the debit side, i.e. the individual direct debit transactions. The data is a unique set for each direct debit transaction and is contained in Segment Group 11 through Segment Group 23. There can be one or many individual transactions within each batch.

The structure of the message is designed to allow several B level batches, each being followed by one or more related C level transactions. Each C level is followed by its associated remittance details.

* Scenario.

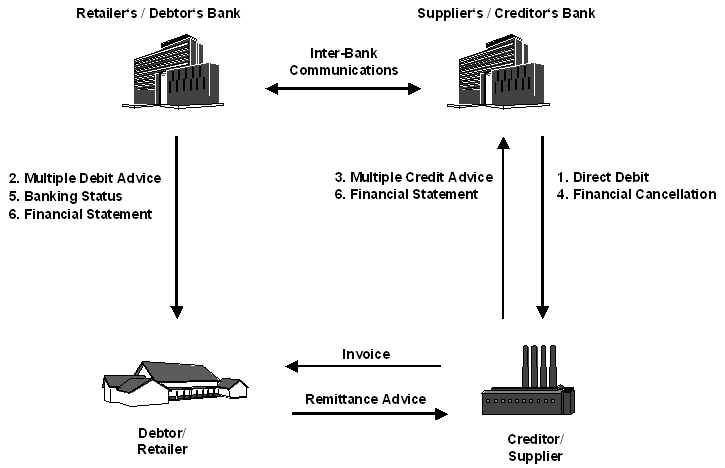

While the Direct Debit message is similar in content to the Multiple Payment Order (PAYMUL) message, it is very different in application. The Multiple Payment Order message is sent by an ordering party (normally the payer or buyer) to instruct it’s bank to effect a payment to a names beneficiary or beneficiaries (payee or supplier). The Direct Debit message is almost a complete inversion of this scenario.

The Direct Debit message is sent by a Creditor (beneficiary/payee/supplier) to its bank instructing the bank to collect funds from the account of a Debtor (payer/buyer). The Direct Debit message will normally be subject to a Direct Debit Mandate. A Direct Debit Mandate is an agreement between the Creditor and the Debtor, which allows the Creditor to demand payment from the bank of the Debtor.

The processes which follow the Direct Debit are the same as those which occur after a Multiple Payment Order message, i.e., debiting of the debtors account is reported to the debtor using the Multiple Debit Advice (DEBMUL) message, crediting of the Creditor’s account is reported to the creditor using the Multiple Credit Advice (WREMUL) message, etc.

|